Alright folks, today I’m gonna walk you through my whole experience figuring out this “hao stock” thing everyone kept buzzing about. Felt like everyone was whispering about it at the coffee machine, ya know? I was curious, maybe a little skeptical, but decided to dive in headfirst.

Starting From Square One

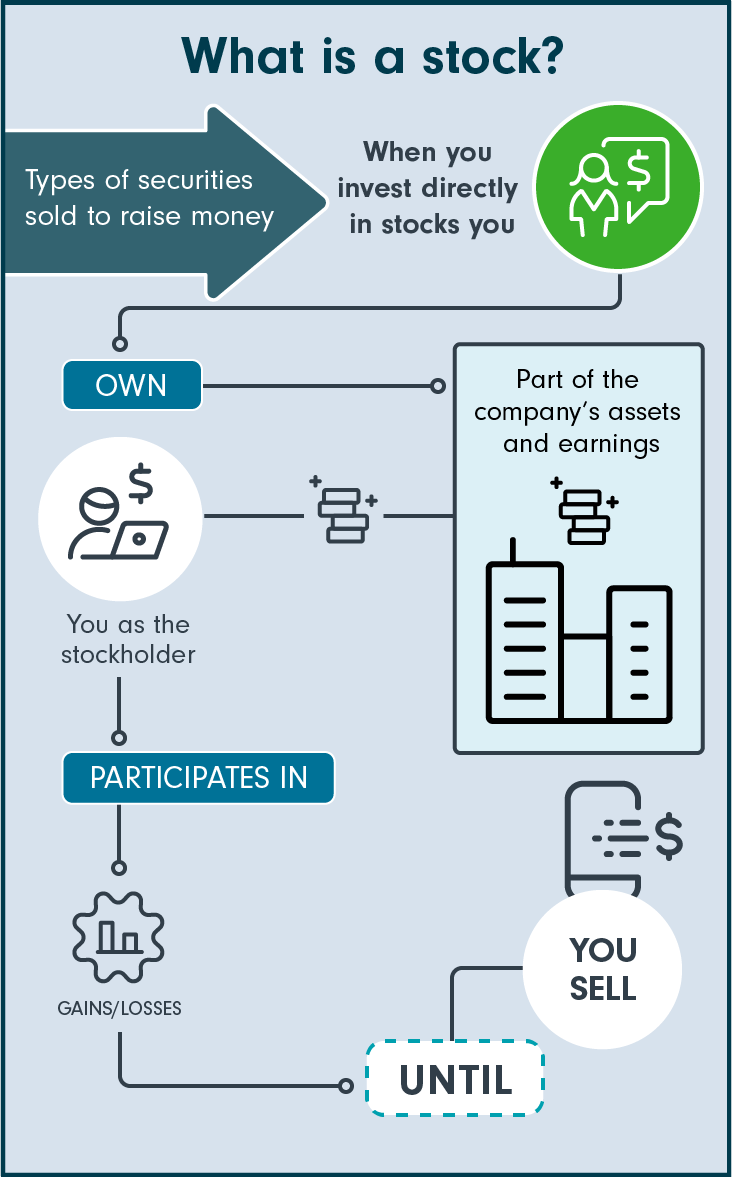

First off, I knew absolutely nothing about stocks. Like, zero. Zip. Zilch. Stocks were just those green and red numbers scrolling on the bottom of the news channel to me. So, I did what anyone would do – I googled. Typed in “what’s a stock?” and “why should I care?” Felt kinda silly, but hey, gotta start somewhere.

Found out super basic stuff:

- Buying a stock means you own a tiny, tiny piece of that company.

- If the company does well, hopefully, your little piece becomes worth more.

- Some companies even give you a bit of cash back every now and then (they call this a “dividend”). Sounds like free money, but I wasn’t buying it yet.

Why Everyone Talked About Hao Stock

Then, I specifically looked up this “hao stock”. Wanted to understand the hype. Read stuff saying:

- It’s been around for a while, seems stable, not some flash-in-the-pan thing.

- People were saying it paid these dividends regularly, like clockwork. That caught my attention.

- Talked about how it’s involved in things people always need, everyday stuff. Less risk if everyone needs what they do, right?

Still felt abstract though. Like, okay, sounds good on paper, but what’s the real point for me?

My Lightbulb Moment (Kinda)

Here’s where I finally got it, the whole “why invest” part. It hit me mostly with two things:

First, that whole “owning a piece” thing started to make sense. Instead of my money just sitting in my savings account doing practically nothing (thanks for nothing, tiny interest!), putting it into a piece of a company meant it could potentially grow. Keep up with rising prices? Maybe even beat them? That felt powerful.

Second, those dividends. Reading stories from people who bought this hao stock years ago, and how those little cash payments every few months added up over time. Like, a small trickle becoming a steady stream later on. That’s passive income, folks. Money showing up just because I owned something. Way cooler than watching paint dry in my bank account.

Third, it’s a way to actually participate in a business doing well. Instead of just being a customer, you get to be a tiny part of their success. That’s kinda neat.

How I Actually Took the Plunge

Okay, convinced enough to try. Here’s what I actually did:

- Picked a platform: Signed up with one of those big, easy-to-use stock apps everyone uses. Took maybe 15 minutes, felt weird giving all my info but seemed legit.

- Started small: No way was I throwing my life savings in. Sent over a chunk I could honestly afford to lose without crying. Like, money I was okay not seeing for a long while.

- Hit buy: Searched for “hao” stock code, found it, clicked BUY, typed in my amount, and… whoosh. My money was gone, replaced by little numbers saying I owned X shares.

Felt a bit nervous right after! Like, “What did I just DO?” But then… nothing happened immediately. Stocks aren’t instant lottery tickets.

What Happened Next & What I Learned

The share price? Went up a little. Then down a little. Mostly hung around where I bought it. No dramatic jumps. But the real win came about 3 months later. Logged in and saw a small payment in my app balance. My first dividend! It wasn’t life-changing, but seeing that cold hard cash land, just for owning the stock? That felt legit. Proof of concept right there.

What I took away from the whole experiment:

- Investing isn’t magic. It takes time. Sometimes it’s boring.

- The main benefit isn’t getting rich overnight. It’s about making your money work for you over the long haul – growing slowly and maybe giving you regular cash bits.

- Things like “hao stock” get attention for a reason: stability and paying you back.

- Starting small and simple is key. Dip your toe in, see how it feels, learn as you go. Don’t overcomplicate it.

Honestly? Happy I did it. Makes me feel a bit smarter about my money. Now I get what people were whispering about.